Global Content Lead - Tech & Consulting

Subscribe to the newsletter

For organizations deciding to extend the life of Microsoft AX to D365 Finance and Operations, it’s valuable to evaluate the comprehensive economic impact of this choice. To offer insights into the return on investment gained from transitioning from Microsoft Dynamics AX to Microsoft Dynamics 365 applications hosted in the cloud, Forrester Consulting carried out a Total Economic Impact (TEI) analysis that elaborated on the benefits that businesses obtained from moving to the most recent Cloud-based D365 Solution.

This blog delves into the motivations behind organizations transitioning from outdated ERPs like Microsoft AX to D365 Finance and Operations. It also offers a concise overview of Forrester’s Total Economic Impact (TEI) study, which assesses the potential return on investment (ROI) achievable by migrating from existing on-premises deployments of Microsoft Dynamics AX to equivalent Microsoft Dynamics 365 applications hosted in the cloud.

The dynamics of change

Before discussing the financial aspects, let’s briefly discuss why organizations are increasingly shifting to cloud-based ERP solutions like Dynamics 365 Finance and Operations.

- Scalability: The cloud offers unparalleled scalability, allowing your organization to adapt quickly to changing business needs. You can scale up or down without the capital expenses associated with traditional on-premises solutions.

- Security and compliance: Forward-thinking companies invest substantially in security and compliance measures, and Cloud-enabled Dynamics 365 offers comprehensive security features. This is especially crucial in an era where data breaches and regulatory compliance are significant concerns.

- Mobility and accessibility: Cloud-based ERPs can be accessed from anywhere with an internet connection, facilitating remote work and global collaboration.

- Cost predictability: Cloud solutions typically operate on a subscription-based model, offering predictable costs and eliminating the need for large upfront investments.

Discovering the total economic impact of migrating from AX to D365

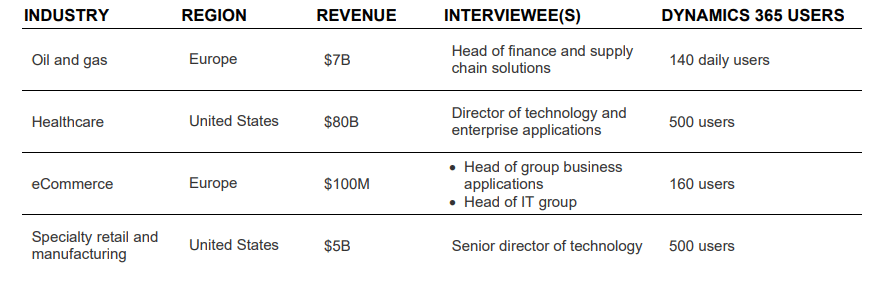

Forrester interviewed four organizations that recently migrated from their legacy, on-premises Dynamics AX solution to Dynamics 365 in the cloud to better understand the benefits, costs, and risks of this investment. Interviewed customers include the following:

The drivers behind the decision for AX to D365 migration

Microsoft Dynamics 365 (D365) is driven by several key factors and business considerations. Here are the primary drivers behind such a migration:

End of support and outdated technology: Microsoft typically announces end-of-support dates for its software products, including Dynamics AX versions. When a version reaches the end of its support lifecycle, it no longer receives security updates, bug fixes, or compliance updates. This can pose significant security and compliance risks for organizations, making migration necessary to ensure system reliability and data security.

Access to new features and functionality: D365 offers a range of new features and enhanced functionality, helping organizations streamline their operations, improve productivity, and stay competitive. These features include advanced analytics, integration with other Microsoft services, enhanced mobility, and more.

Cloud adoption and scalability: D365 is designed for the cloud, providing organizations greater scalability and flexibility. Migrating to the cloud can lead to cost savings, as it eliminates the need for on-premises infrastructure maintenance and allows for more efficient scaling of resources based on demand.

Improved user experience: D365 features a modern, user-friendly interface that enhances the user experience. The improved interface can boost user productivity and satisfaction, leading to better adoption and utilization of the system.

Better integration capabilities: D365 offers robust integration capabilities, allowing organizations to connect more seamlessly with other Microsoft services and third-party applications. This enhances data flow and process automation.

Data analytics and business intelligence: D365 provides advanced data analytics and access to business intelligence tools, enabling organizations to gain insights into their business operations and make data-driven decisions.

Compliance and regulatory requirements: Compliance requirements, such as GDPR and industry-specific regulations, can change over time. D365 offers features and tools to help organizations stay compliant with evolving regulations.

Mobile and remote workforce: With the increasing trend toward remote work, D365’s mobile capabilities allow employees to access critical business information and perform tasks from anywhere, improving productivity and responsiveness.

Key findings of the study

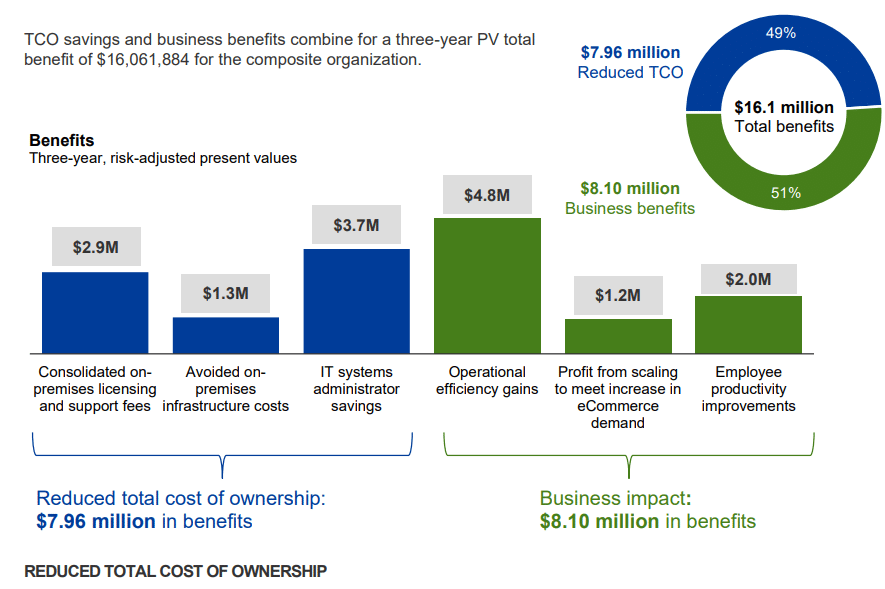

Migrating from Microsoft Dynamics AX to 365 cloud allowed these organizations to reassess how their finance ERP system interacts with their business. This upgrade facilitated improved decision-making through real-time insights and gave them the agility necessary to innovate and thrive in challenging market conditions. It led to more efficient processes, cost savings by avoiding infrastructure and solution expenses, and increased personnel productivity, ultimately benefiting these organizations.

*Note: A composite organization is a representation used in research and analysis to illustrate the typical characteristics, behaviors, and outcomes of a group of organizations in a particular context. It combines common traits and data from multiple real-world organizations to create a standardized model for analysis.

Quantified business benefit

- Enhancements in finance personnel productivity by up to 55%. By adopting Dynamics 365 Finance as a standard, the composite organization* simplifies and unifies financial processes across various regions and teams. This enables the utilization of real-time data for critical business decision-making and, in turn, boosts the efficiency of the finance staff while reducing the necessity for external hires. This translates to nearly $2.3 million in productivity savings and a reduction in hiring costs over a three-year period for the composite organization.

- Improvements in IT staff productivity exceeding $400,000. The adoption of Dynamics 365 Finance as a standard solution allows the organization to save on IT administrator and developer staff hours. This is achieved by implementing a finance ERP system that is easier to maintain, offering enhanced functionality with reduced customizations required for development and support.

- Savings from legacy systems totaling over $3.5 million. The migration to Dynamics 365 in the cloud results in cost savings for the composite organization. These savings stem from avoiding costly infrastructure upgrades, eliminating redundant ERP solutions, and reducing external support expenses.

*Note: A composite organization is a representation used in research and analysis to illustrate the typical characteristics, behaviors, and outcomes of a group of organizations in a particular context. It combines common traits and data from multiple real-world organizations to create a standardized model for analysis.

Quantified TCO savings

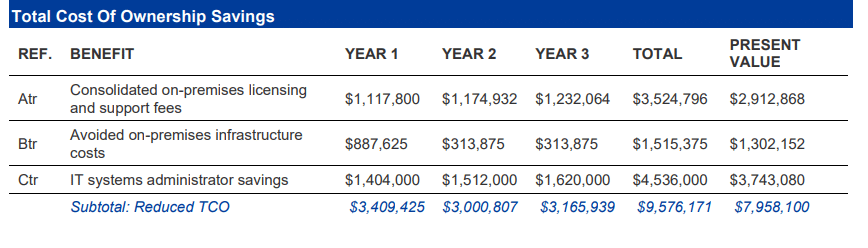

In terms of quantified TCO savings, Three-year, risk-adjusted present value (PV) quantified benefits for the composite organization include:

- Avoid over $2.9M in on-premises licensing and support fees. Over three years, the subscription fees for Dynamics 365 in the cloud resulted in savings of over 8% compared to the cost of Microsoft Dynamics AX assurance fees, support costs, and other ERP-related license fees.

- Saved over $1.3M in on-premises infrastructure costs. Initial savings include hardware and software costs for infrastructure refreshments. Annual savings in the form of software licensing, maintenance, power, and cooling costs accrue each year as infrastructure is phased out.

- Reallocated over $3.7M in IT systems administrator labor. As on-premises infrastructure is phased out and the organization’s ERP deployment is managed in the cloud, IT systems administrators are reallocated to other value-adding activities throughout the organization.

Unquantified benefits

The interviewed organizations also highlighted unquantified advantages:

- Enhanced user experience: Transitioning to Dynamics 365 in the cloud boosts user productivity and enhances employees’ daily interactions by simplifying tasks like receipt entry and providing improved access to ERP functions across various devices. Interviewees also pointed out that integration with Office 365 applications such as Outlook, Teams, and SharePoint contributes to an overall improved experience.

- Increased reliability: By relocating critical business applications like ERP solutions from on-premises infrastructure to the cloud, the composite organization gains greater reliability as hardware failures and planned downtime become obsolete. One of the eCommerce interviewees said their peak season the year before experienced significant improvements in performance and reliability with Dynamics 365 in the cloud.

- Improved customer experience: All interviewees conveyed that their organizations are now better equipped to deliver a superior customer experience, driven by enhancements in performance, reliability, and service agility facilitated by Dynamics 365 in the cloud.

The bigger picture

Overview of Dynamics 365 Finance and Operations

Microsoft Dynamics 365 Finance and Operations unifies business management across finance, manufacturing, retail, supply chain, warehouse, inventory, and transportation management with built-in predictive analytics and intelligence to help enterprises run a modern global business. It provides organizations with a service that can support their unique requirements and rapidly adjust to changing business environments without the hassle of managing infrastructure.

Run smarter with connected operations and financial agility

Bring speed, agility, and efficiency to your manufacturing to optimize production planning, scheduling, operations, and cost management.

Achieve operational excellence. Accelerate the speed and accuracy of your business operations with streamlined processes that effectively coordinate people, assets, and resources to reduce costs, improve service levels, and drive growth.

Drive strategic innovation. Connect your global operations and reorient growth discussions from static views focused on historical data to dynamic views of future trends, opportunities, and strategic options.

Share a 360-degree view of your business. Unify your financials and business operations to bring organizational visibility and provide real-time and predictive insights for data-driven decisions to capitalize on growth opportunities.

Improve financial performance. With role-based workspaces that provide core KPIs, charts, and financial performance, you can gain global visibility into your business’s financial health and help drive accountability, efficiency, and growth.

Increase profitability and drive margin revenue growth with a centralized, global financial management solution that delivers robust financial intelligence and embedded analytics in real-time.

Select best-fit manufacturing processes. Optimize manufacturing processes based on current demand and market trends by creating a mix of discrete, lean, and process in a single, unified solution to support your processes across the supply chain.

Improve operational procedures. Optimize manufacturing parameters for each product family, including make-to-stock, make-to-order, pull-to-order, configure-to-order, and engineer-to-order.

Innovate with a modern and adaptable platform.

Drive innovation with an intelligent application that is easy to tailor, scale, extend, and connect to other applications and services you already have to make full use of existing investments.

Enable flexible deployment. Drive continuous business growth with rapid, hybrid deployment options that adjust to changing requirements, comply with regulations, and maximize existing investments. Use a combination of cloud, hybrid, and on-premises deployments to meet your global business requirements of today and have the flexibility and ease to change as your business needs evolve over time.

Adapt quickly. Accelerate time-to-market and adapt the application to your needs with no-code visual editors and tools that make it easy to build and deploy web and mobile apps. Manage your growing global business by rapidly deploying new subsidiaries in record time. The ability to copy an existing legal entity’s setup to a new company allows the onboarding of a new location to be quick and consistent with the company’s best practices.

Extend and connect. Automate processes across Dynamics 365 applications and third-party systems for a unified experience.

Summing up

Ready to embark on your journey to Microsoft Dynamics 365 Finance and Operations? Don’t tackle this complex migration alone. Trust a reliable partner like Confiz, offering Dynamics AX 2012 to Dynamics 365 upgrade services, to guide you every step of the way.

Opt for our one-week FREE migration assessment offer to evaluate your business needs and design a path for a successful migration. Take the first step towards a seamless transition to the cloud and kickstart your digital transformation journey. Contact us at marketing@confiz.com to get started today.